Introduction of 9th IT – best course

Vocational Education की इस सीरीज में हमने पिछली पोस्ट में Vocational Education in India के बारे में जाना है। मध्यप्रदेश में व्यावसायिक शिक्षा के अंतर्गत अनेक ट्रेड संचालित की जा रही है। मध्यप्रदेश में व्यवसायिक शिक्षा NSQF (National skill qualification Framwork) के अंतर्गत संचालित की जा रही है। इस पोस्ट के माध्यम से मैं आपको Introduction of 9th IT के बारे में जानकारी देने वाला हूँ।

Introduction of 9th IT

Vocational Education में IT – ITeS कक्षा 9th में पढ़ाया जाने वाला level-1 है। IT – ITes क्या है, इसका क्या उपयोग है तथा यह वर्तमान में कहां-कहां यूज़ हो रहा है आप इसके बारे में इस कक्षा में पढ़ेंगे।की-बोर्डिंग कौशल जिसमें टाइपिंग कैसे करते हैं, टाइपिंग के लिए किन किन बातों का ध्यान रखना है तथा कीबोर्ड में उपलब्ध बटन (Keys) के बारे में बताया जाएगा। इसके अतिरिक्त डाटा एंट्री ऑपरेटर के लिए उपयोगी Tools के बारे में जानकारी दी जाएगी।

इसमें वर्ड प्रोसेसर, स्प्रेडशीट, प्रेजेंटेशन सॉफ्टवेयर के बारे में सिखाया जाएगा जिसके लिए एमएस ऑफिस (MS OFFICE) का मुख्य रूप से उपयोग किया जाएगा।

वर्ड प्रोसेसर मैं आपको (MS WORD) एमएस वर्ड, स्प्रेडशीट में एमएस एक्सल (MS EXCEL), तथा प्रेजेंटेशन के लिए एमएस पावरप्वाइंट (MS POWER POINT) का उपयोग किया जाएगा। इसके अतिरिक्त आपको रोजगार कौशल के बारे में पढ़ाया जाएगा।

Course Content of 9th IT

- 1 – IT – ITeS उद्योग का परिचय

- 2 – डाटा एंट्री और कीबोर्डिंग कौशल

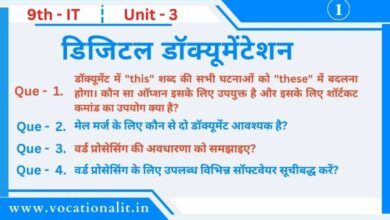

- 3 – डिजिटल डॉक्यूमेंटेशन

- 4 – इलेक्ट्रॉनिक स्प्रेडशीट

- 5 – डिजिटल प्रेजेंटेशन

कक्षा 9th में इस विषय से पास होने पर विद्यार्थी को एन.सी.डब्ल्यू.पी. (National Certifitificate for Work Prepraion) लेवल – 1 का Certifitificate दिया जाएगा।